Wise—foreign transfers, without the fuss

Sending money abroad with your N26 personal account is easy, fast and reliable—no hidden fees, no hassle.

Pick your destination—we’ll get your money there

Paying family or friends across the world, or moving funds into a bank account back home to settle the bills? Or maybe you’re just looking for a cheap way to get your cash from A to B?

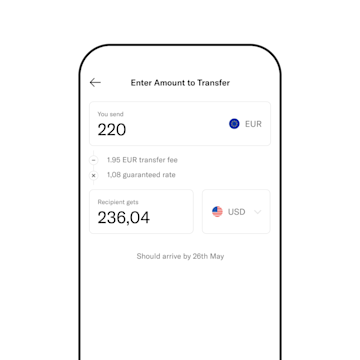

With over 38 currencies at your disposal, sending money internationally is faster and easier than ever with Wise. The handy feature is seamlessly integrated into your N26 app, so you won’t be redirected anywhere to complete the transaction. Everything you need is right there, on your smartphone.

Low fees, with full transparency

When transferring money internationally, you’ll be charged as little as possible. Benefit from the real market exchange rate and low fees compared to traditional banks and other money transfer services. And before parting with your cash, get a detailed overview of all the charges you’ll incur.

Full transparency and zero surprises, at every step of the way. The same TransferWise’s terms and conditions apply, but all in one place in the N26 app.

Your N26 account at a glance

Forget paying for the basic stuff

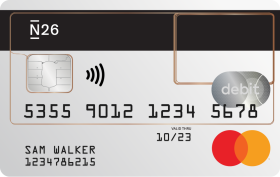

With your virtual Mastercard, you can do all your payments online, in apps and in stores via your digital wallet. And we’ll always offer a feeless checking account that does what you need.

Contactless made effortless

Your N26 card allows you to use contactless payments thanks to the NFC technology, but also mobile payments. Try it out and breeze past the checkout in stores.

Free card payments worldwide

Use your virtual Mastercard and you pay what’s on the pricetag. Never pay a foreign transaction fee again.

We’re here for you. In several languages

If you have any questions or run into any problems, our Customer Service team will be on hand to help you in English, French, German, Spanish and Italian.

Sign up

Hit the button below and enter your personal details in order to create your account.

Verify your identity

Please have a valid ID at hand. We don't have branches so you can verify your identity within the app.

Add your card to your wallet

Your N26 virtual debit card is ready to use.

Enjoy your N26 account!

You're good to go! You can already top up your account and start using your virtual card.

Frequently asked questions

What do I need to open a free bank account with N26?

You must meet the following requirements to open an N26 Standard free bank account:

- Be over the age of 18

- Live in an eligible country

- Have your own smartphone

- Not yet have an online account with N26

- Have a valid ID

Is N26 secure?

N26 has been granted a full German banking license from BaFin. By law, each customer’s funds are protected up to €100,000 by the German Deposit Protection Scheme. With 3D Secure, Mastercard Identity Check, and fingerprint and face recognition, the security of our customer's online payments is always guaranteed.

What are the benefits of using the free checking account?

The free bank account lets you manage all your finances under one app, whether at home or traveling. In addition, we don’t charge you any hidden fees when withdrawing money from an ATM, or when making payments in foreign currencies. Alongside getting instant push-notifications after every transaction, benefit from Spaces sub-accounts for better saving, automatic spending categorization with Statistics, and the ability to make and receive immediate funds from other N26 customers with MoneyBeam.

With N26 You and N26 Metal you can also withdraw money at no fees worldwide, and enjoy exclusive benefits such as discounts. On top of this, premium accounts come with an extensive package of travel and lifestyle insurance, courtesy of Allianz.

How much does it cost to open an N26 bank account?

The standard N26 bank account is free and doesn’t charge any opening or maintenance fees. The N26 Smart bank account costs €4.90 per month, the N26 You bank account costs €9.90 per month and the N26 Metal account is available for €16.90 per month, with a 12-month commitment period. To open an N26 account, no deposit or minimum income is required.

How to open an N26 bank account?

If you meet all the requirements, you can open your checking account with N26 for free and within minutes. All you need is a smartphone and your photo ID. It's easy with our digital authentication process. Download our app to open an account—you don’t even need a minimum deposit amount.